When it comes to safeguarding our beloved pets, ensuring their health and well-being often means navigating a maze of potential costs. While pet insurance has become a common consideration, it's certainly not the only path. In fact, many savvy pet parents are discovering powerful Alternatives to Pet Insurance: Self-Insurance & Wellness Plans that offer control, flexibility, and often, more predictable financial outcomes.

These alternatives aren't just for budget-conscious owners; they're for anyone seeking a more direct, personalized approach to managing their pet's health expenses without the complexities of traditional insurance policies.

At a Glance: Smart Alternatives to Pet Insurance

- Self-Insurance: Build a dedicated savings fund specifically for your pet's vet bills and emergencies. You control the money, avoid premiums, and have ultimate flexibility.

- Pet Wellness Plans: These are designed for routine, preventive care like exams, vaccinations, and dental cleanings. They help spread out predictable costs and encourage proactive health management.

- Preventive Care Focus: Investing in a healthy diet, regular exercise, and consistent vet check-ups is the single best way to reduce the likelihood of costly illnesses down the road.

- Discount Programs & Telehealth: Explore vet clinic packages, loyalty programs, and online services that offer reduced rates on medications, supplies, and even virtual vet consultations.

- Hybrid Approach: Many owners find success by combining a robust pet care savings fund with a wellness plan for routine care, covering all bases without traditional insurance.

Beyond Premiums: Why Pet Owners Are Looking for New Solutions

The world of pet care is a wonderful one, but it comes with a price tag. From routine check-ups and vaccinations to unexpected injuries or illnesses, veterinary bills can quickly add up. Traditional pet insurance aims to cover these unforeseen costs, but it often comes with its own set of challenges: monthly premiums that can feel like a drain, unexpected deductibles, co-pays, and the potential for denied claims or excluded pre-existing conditions.

These factors can lead to frustration and uncertainty, prompting many pet owners to seek alternatives that offer more transparency and direct control over their finances. After all, when you're making financial decisions for your furry family member, clarity and peace of mind are paramount. It’s also a common topic of discussion online, where what many pet owners discuss on platforms like Reddit often highlights these very frustrations.

The Power of Self-Insurance: Your Pet's Personal Emergency Fund

Imagine having a dedicated financial cushion, ready to deploy at a moment's notice for any pet-related expense—without needing to file a claim, wait for approval, or decipher policy jargon. That's the essence of self-insurance for pet care. It's about taking direct financial responsibility for your pet's health costs by building a robust, accessible savings fund.

What Exactly is Pet Self-Insurance?

Pet self-insurance means you act as your own insurance company. Instead of paying monthly premiums to an insurer, you consistently contribute to a separate savings or investment account earmarked exclusively for your pet's medical needs. This fund grows over time, creating a powerful safety net for everything from annual exams to major surgeries.

The Benefits:

- Complete Control: It's your money. You decide when and how to spend it.

- No Denials: As long as you have funds, your pet gets the care they need without worrying about policy exclusions or claim rejections.

- Flexibility: Use the money for vet visits, medications, specialized treatments, prescription food, or even unexpected training needs—anything pet-related.

- No Premiums or Deductibles: You avoid ongoing payments that might not be used, and there's no fixed amount you have to pay out-of-pocket before coverage kicks in.

- Potential for Growth: If you choose a high-yield savings account or a conservative investment vehicle, your fund can actually grow over time.

Potential Drawbacks & Considerations: - Discipline Required: You need to be consistent with contributions, even when other expenses crop up.

- Initial Build-Up Time: It takes time to accumulate a substantial fund, meaning you might be vulnerable to large, unexpected costs early on.

- Risk of Depletion: A major medical emergency could quickly deplete your fund, requiring you to rebuild it.

How to Build a Robust Pet Care Fund

Starting a pet care savings account is surprisingly simple, but consistency is key. Here's a step-by-step guide:

- Set a Realistic Monthly Goal: Begin with an amount that fits your budget, even if it's small. Can you save $20, $50, or $100 a month? Even $20 a month accumulates to $240 in a year, which can cover a routine vet visit and some vaccinations. Research average vet costs for your pet's breed and age to set a more informed target.

- Open a Separate Savings Account: This is crucial. A dedicated account, separate from your regular checking or emergency fund, prevents you from accidentally dipping into pet funds for other expenses. Look for a high-yield savings account to maximize your growth.

- Automate Your Deposits: Set up an automatic transfer from your checking account to your pet savings account each payday. This "set it and forget it" approach ensures consistent, effortless saving and removes the temptation to skip a contribution.

- Track Your Expenses: Keep a record of your pet's actual medical expenses over time. This helps you understand your average costs and allows you to adjust your monthly savings goal if needed. You might realize your initial goal was too low or, happily, too high.

- Use Windfalls Wisely: Tax refunds, work bonuses, unexpected gifts, or even money saved from cutting back on other expenses can rapidly boost your pet fund. Treat these as opportunities to accelerate your savings and build a stronger safety net.

Think of this fund as your pet's personal health endowment. The more you put in, the more securely you can face their future health needs.

Unpacking Pet Wellness Plans: Proactive Care, Predictable Costs

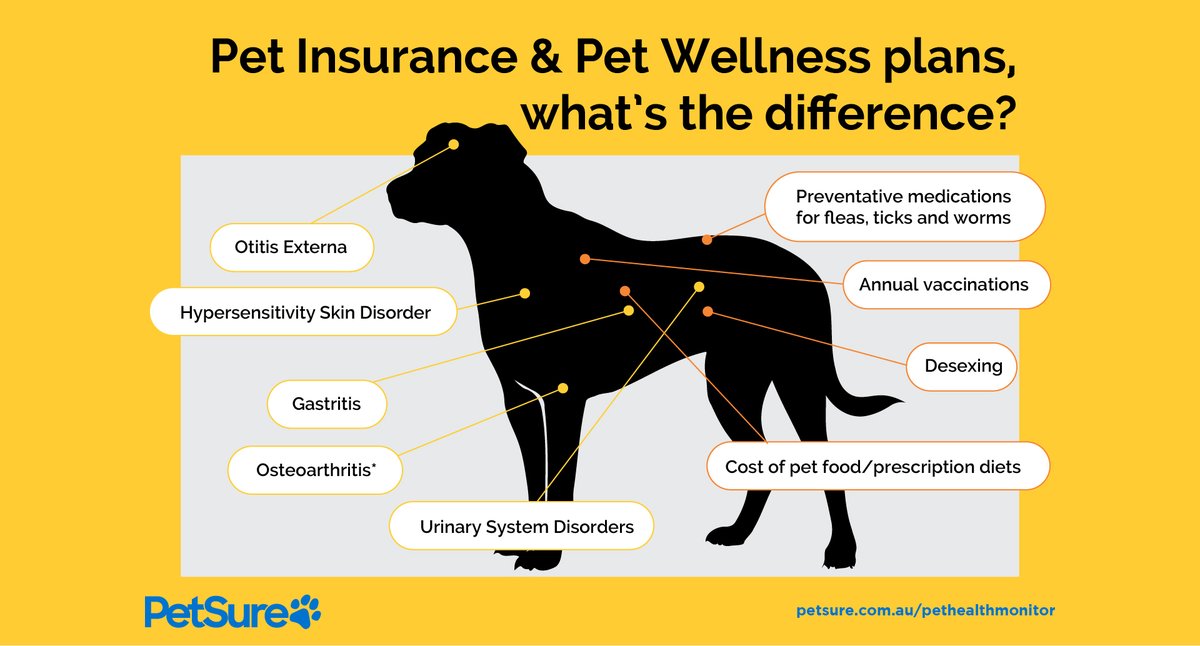

While self-insurance covers unexpected large costs, pet wellness plans tackle the predictable, ongoing expenses of keeping your pet healthy. These plans are the opposite of traditional pet insurance; they're designed specifically for preventive care.

What Are Pet Wellness Plans?

A pet wellness plan is a preventive care program that helps you manage and budget for your pet's routine health costs. Unlike pet insurance, which steps in for accidents or illnesses, wellness plans focus on keeping your pet healthy to prevent major issues from arising. They essentially allow you to pay a monthly fee to cover a set list of annual preventive services.

Key Things They Typically Cover:

- Annual wellness exams

- Vaccinations & boosters

- Routine bloodwork or fecal tests

- Basic or preventive dental cleanings

- Some plans may also include spay/neuter surgery or microchipping.

How They Differ from Traditional Pet Insurance

The distinction is critical:

- Focus: Wellness plans are for preventive care. Insurance is for accidents and illnesses.

- Reimbursement: Wellness plans often have fixed reimbursements or direct billing for covered services. Insurance has deductibles, co-pays, and annual limits, usually requiring you to pay upfront and then submit a claim.

- Waiting Periods: Many wellness plans have short or no waiting periods for benefits to kick in. Insurance often has longer waiting periods for specific conditions (e.g., orthopedic issues).

- Pre-existing Conditions: Wellness plans are generally not affected by pre-existing conditions since they cover routine health regardless. Insurance often excludes them.

Navigating the Top Wellness Plans: Finding Your Best Fit

The market for pet wellness plans has grown significantly, offering a variety of options tailored to different needs and budgets. Here's a look at some leading providers and their standout features, based on their typical offerings:

- Pumpkin Wellness (Best Overall): For dog owners seeking a balanced, worry-free plan with predictable routine costs. Pumpkin is unique for offering a standalone wellness club. It often includes valuable perks like 24/7 PawSupport access and exclusive discounts on pet brands, making it a comprehensive choice for proactive care.

- Lemonade (Best Affordable): If you're a budget-conscious dog owner needing dependable preventive care, Lemonade's plan stands out. It features a lower entry price point and a modular structure, allowing you to customize the coverage to fit your specific needs without overspending.

- Spot Pet Wellness (Best for Multiple Pets): For households with more than one furry friend, Spot offers an attractive 10% multi-pet discount. This can lead to significant savings, making it a more cost-effective solution for ensuring several animals receive consistent preventive care.

- CarePlus by Chewy (Best for Medications & Prescription Food): Designed for pet parents managing ongoing medication or prescription diet costs, CarePlus by Chewy offers optional wellness care bundling. A major perk is free, unlimited telehealth through Chewy’s vet-access service, providing convenient access to veterinary advice.

- Embrace (Best for Puppies & Kittens): Embrace provides early protection and structured preventive care crucial for young dogs or cats. It uniquely reimburses for services beyond basic vet visits, potentially covering grooming, training, medicated shampoos, prescription diet food, and supplements—ideal for setting up a healthy foundation.

- ASPCA Preventive Care (Best for Vaccinations & Boosters): This plan focuses intently on ensuring timely vaccinations and boosters. It covers core and select non-core vaccines with no waiting period and offers fixed reimbursements, making it straightforward to manage this essential aspect of preventive health. The Prime tier adds more diagnostic coverage like bloodwork and urinalysis.

- Pets Best (Best for Senior Pets): Tailored to support aging pets, Pets Best covers routine screenings and age-related needs. It offers state-specific pricing that typically remains predictable, shielding owners from age-related price hikes common in other plans, making long-term care more manageable.

- Nationwide (Best for Highest Annual Payout): For dog owners needing robust reimbursement limits, Nationwide provides a generous $800 wellness maximum, often exceeding rivals' offerings (which are typically around $450-535). Its plan includes dental care and spay/neuter, with a quick 1-day activation period for benefits.

- MetLife (Best With No Waiting Periods): Offering immediate access to wellness benefits, MetLife stands out with a 0-day waiting period for preventive care. Coverage starts at midnight on the policy's effective day, with fixed reimbursements for over a dozen services, including behavior training. They also provide dual 365/575 tiers for scalable coverage options.

- FIGO (Best for Microchipping): Ensuring essential microchipping is covered, FIGO dedicates $15-30 to microchipping and health certificates. It boasts a zero waiting period and supports app-direct claims for convenience, making it easy to protect your pet's identity.

- Fetch (Best Premium for Extra Coverage): For those seeking expanded wellness benefits, broader reimbursement, and higher limits, Fetch offers a premium option. It features no sub-limits on exams or vaccines and provides fast digital claims coupled with a 24/7 vet line for immediate assistance.

Vet Clinic Wellness Plans: Don't forget to ask your local veterinary clinic about their own wellness plan offerings. Many clinics provide in-house packages that bundle routine care services, often at a discounted rate, building a strong relationship with your primary care provider.

Benefits of Wellness Plans: - Predictable Budgeting: Monthly fees help you spread out the cost of routine care.

- Encourages Preventive Care: Knowing these services are covered makes it easier to keep up with annual check-ups and vaccinations, catching issues early.

- Early Detection: Regular visits facilitated by a plan mean potential health problems are identified and addressed sooner, often leading to less invasive and less costly treatments.

Drawbacks & Considerations: - Limited Scope: They don't cover accidents or illnesses, meaning you'll still need another plan (like self-insurance) for emergencies.

- Cost vs. Benefit: Carefully compare the annual cost of the plan against the cost of paying for each service individually. Ensure the savings are significant enough to make it worthwhile for your pet's specific needs.

- Potential for Unused Benefits: If your pet is exceptionally healthy and you rarely use all the covered services, you might end up paying for benefits you don't fully utilize.

Choosing the right wellness plan ensures consistent, reliable care, keeping vaccinations on schedule, dental cleanings affordable, and everyday checkups stress-free, ultimately leading to a happier, healthier life for your pet.

The Unsung Hero: Prioritizing Preventive Pet Care

Beyond specific financial tools, the single most powerful strategy for managing pet care costs is proactive, preventive care. An ounce of prevention truly is worth a pound of cure, especially in veterinary medicine. Investing in your pet's baseline health significantly reduces the likelihood of costly illnesses and emergency visits down the road.

Why Preventive Care is the Ultimate Cost-Saver

Think of it this way: addressing a minor dental issue with a routine cleaning is far less expensive and stressful than treating advanced periodontal disease, which can lead to tooth extractions, infections, and even organ damage. Similarly, consistent flea and tick prevention costs pennies compared to treating a vector-borne illness like Lyme disease or managing a severe flea allergy.

Key Preventive Actions to Prioritize:

- Regular Vet Check-ups: Annual or semi-annual exams are critical for early detection of health issues. Your vet can spot subtle changes, lumps, or behavioral shifts that might indicate a problem long before it becomes serious and expensive to treat.

- Vaccinations and Parasite Control: These are fundamental defenses against common and often costly diseases. Keeping your pet's vaccinations up-to-date and consistently using flea, tick, and heartworm preventatives are non-negotiable for long-term health and financial savings.

- A Healthy Diet and Exercise: Just like humans, pets thrive on good nutrition and regular physical activity. A high-quality diet strengthens their immune system and maintains a healthy weight, reducing the risk of obesity-related conditions like diabetes, arthritis, and heart disease. Regular exercise keeps them agile, mentally stimulated, and helps prevent injuries.

- Consistent Dental Care: Dental problems are incredibly common in pets and can lead to severe pain and systemic health issues. Brushing your pet's teeth regularly, providing dental chews, and scheduling professional dental cleanings can prevent expensive complications like extractions, root canals, and infections.

- Behavioral Training: A well-trained pet is less likely to engage in dangerous behaviors that could lead to injury (e.g., running into traffic) or stress-related illnesses. Proper socialization also reduces anxiety and aggression, contributing to a calmer, healthier pet and fewer potential incidents.

By consistently implementing these preventive measures, you're not just saving money; you're building a foundation for a longer, happier, and healthier life for your pet.

Smart Strategies: Discounts, Telehealth & Community Support

Even with self-insurance and wellness plans, there are other avenues to explore to further reduce pet care costs and provide comprehensive support. These complementary strategies can make a big difference, especially during challenging times.

Maximizing Vet Wellness Plans and Discounts

Beyond specific brand-name wellness plans, many individual veterinary clinics offer their own in-house wellness packages. These typically cover a year's worth of routine services for a flat fee or monthly payment plan, often including annual exams, vaccinations, flea/tick prevention, and basic diagnostics. These clinic-specific plans not only save money but also foster a strong relationship with your vet, encouraging regular visits that lead to better overall care.

Additionally, always seek out discount programs:

- Pet Stores & Online Pharmacies: Many large pet retailers and online pharmacies offer loyalty programs or membership discounts on medications, food, and supplies. Buying generic medications from reputable online pharmacies can also significantly cut costs.

- Local Animal Organizations: Groups like the ASPCA or local humane societies often provide low-cost vaccination clinics, spay/neuter services, and discounted microchipping events.

- Pet Assure: This is a veterinary discount plan that offers a percentage off all in-house veterinary services at participating vets for a monthly or annual fee. It’s not insurance, but a discount program.

Telehealth Services

The rise of telehealth in veterinary medicine is a game-changer. Many wellness plans, like CarePlus by Chewy and Fetch, now include 24/7 vet access lines or virtual consultations. These services can:

- Offer Quick Advice: Get immediate answers to non-emergency questions.

- Determine Urgency: Help you decide if an issue warrants an emergency vet visit or can wait for a regular appointment, potentially saving a costly ER trip.

- Provide Follow-Up Care: Some vets use telehealth for post-op check-ins or medication adjustments.

Crowdfunding and Community Support

In dire emergencies, when all other funds and options are exhausted, crowdfunding platforms (like GoFundMe, Waggle, or Cause for Paws) and local community support groups can be lifesavers. While not a primary financial strategy, they provide an avenue for support when faced with overwhelming costs. Local animal shelters and rescues often have emergency funds or partnerships with vets to offer discounted services in crisis situations.

Making the Right Choice for Your Furry Family Member

Deciding between traditional pet insurance, self-insurance, a wellness plan, or a combination isn't a one-size-fits-all answer. It depends heavily on your pet's specific needs, your financial discipline, and your risk tolerance.

When is Self-Insurance (Dedicated Savings) Best?

- You have strong financial discipline: You can consistently save and avoid dipping into the fund for other purposes.

- You have an established emergency fund already: This separate pet fund can be built without impacting your general financial stability.

- You prefer complete control: You want to make all decisions without third-party involvement.

- Your pet is relatively young and healthy: Giving you time to build a substantial fund before major health issues are likely.

- You dislike premiums and deductibles: You prefer to pay directly for services as they arise.

When is a Pet Wellness Plan Best? - You want predictable budgeting for routine care: You prefer to spread out the cost of annual exams, vaccines, and dental cleanings.

- You prioritize preventive care: You want to ensure your pet gets all necessary routine treatments.

- Your pet is young or elderly: Puppies/kittens have many initial vaccinations and spay/neuter needs, while senior pets benefit from more frequent screenings.

- You combine it with self-insurance: A wellness plan handles routine, while your savings fund covers unexpected emergencies.

Factors to Consider for Your Decision: - Your Pet's Age and Breed: Young pets have initial expenses (vaccinations, spay/neuter) and then fewer major issues, while older pets and certain breeds are prone to specific, potentially costly conditions.

- Your Financial Comfort Level: How much risk are you willing to assume? Can you comfortably cover a $5,000 emergency bill out-of-pocket if your savings aren't fully built up?

- Your Discipline: Will you consistently contribute to a savings fund, or do you prefer the forced savings of a monthly premium (even for a wellness plan)?

- Local Vet Costs: Research average costs in your area. They can vary widely.

- Your Time: Are you willing to research and manage a savings fund, or do you prefer a simpler, structured plan?

Many pet owners find the sweet spot in a hybrid approach: maintaining a dedicated pet care savings account for emergencies and unforeseen illnesses, plus enrolling in a pet wellness plan to cover and budget for routine preventive care. This combination provides both a safety net for the unexpected and a structured way to manage day-to-day health maintenance, often proving more cost-effective and flexible than traditional pet insurance alone.

Your Next Steps for a Healthier, Happier Pet

Empowering yourself with knowledge about pet care alternatives is the first step toward a more secure future for your furry companion. Here’s how you can put these insights into action:

- Assess Your Pet's Needs: Consider their age, breed, current health, and lifestyle. Does a puppy need immediate vaccination coverage? Is your senior dog prone to dental issues?

- Evaluate Your Finances: Determine what you can realistically set aside monthly for a self-insurance fund and/or a wellness plan. Be honest about your financial discipline.

- Start a Dedicated Savings Fund TODAY: Even if it's just $20 a month, automate that transfer. The sooner you start, the stronger your safety net will become.

- Research Wellness Plans: Look into options like Pumpkin, Lemonade, Spot, or even your local vet's in-house plans. Compare their covered services, costs, and any included perks against your pet's routine needs.

- Prioritize Preventive Care: Schedule those annual check-ups, maintain parasite control, focus on diet and exercise, and don't neglect dental hygiene. This is truly your best investment.

- Explore Discounts: Ask your vet about payment plans or discounts. Look into online pharmacies and local animal welfare organizations for reduced-cost services.

By taking a proactive, informed approach, you can create a robust, personalized financial strategy that ensures your pet receives the best possible care, leading to a long, joyful, and healthy life together.